Introduction

From digital policy purchases to AI-driven claim assessments, insurance is no longer a paper-heavy, branch-bound industry.

Think about how you now get reminders for policy renewals, instant claim status updates, and even customized premium suggestions. Behind the scenes of this smooth user experience is a growing reliance on smart ERP systems designed to simplify operations and decision-making.

That's where ERP for Insurance Management enters the picture. These systems help insurance companies streamline processes like underwriting, claims, compliance, customer support, and reporting, eliminating manual bottlenecks and bringing everything into one dashboard.

Among the many ERP options out there, Odoo ERP stands out for its modular, customizable, and cost-effective approach. Whether you're a small agency or an enterprise-level insurer, Odoo ERP for Insurance Management offers powerful tools to align operations, improve customer service, and ensure compliance—all without getting bogged down by legacy software.

Now that we’ve set the scene, let’s explore the top benefits that make Odoo ERP a smart choice for modern insurance companies.

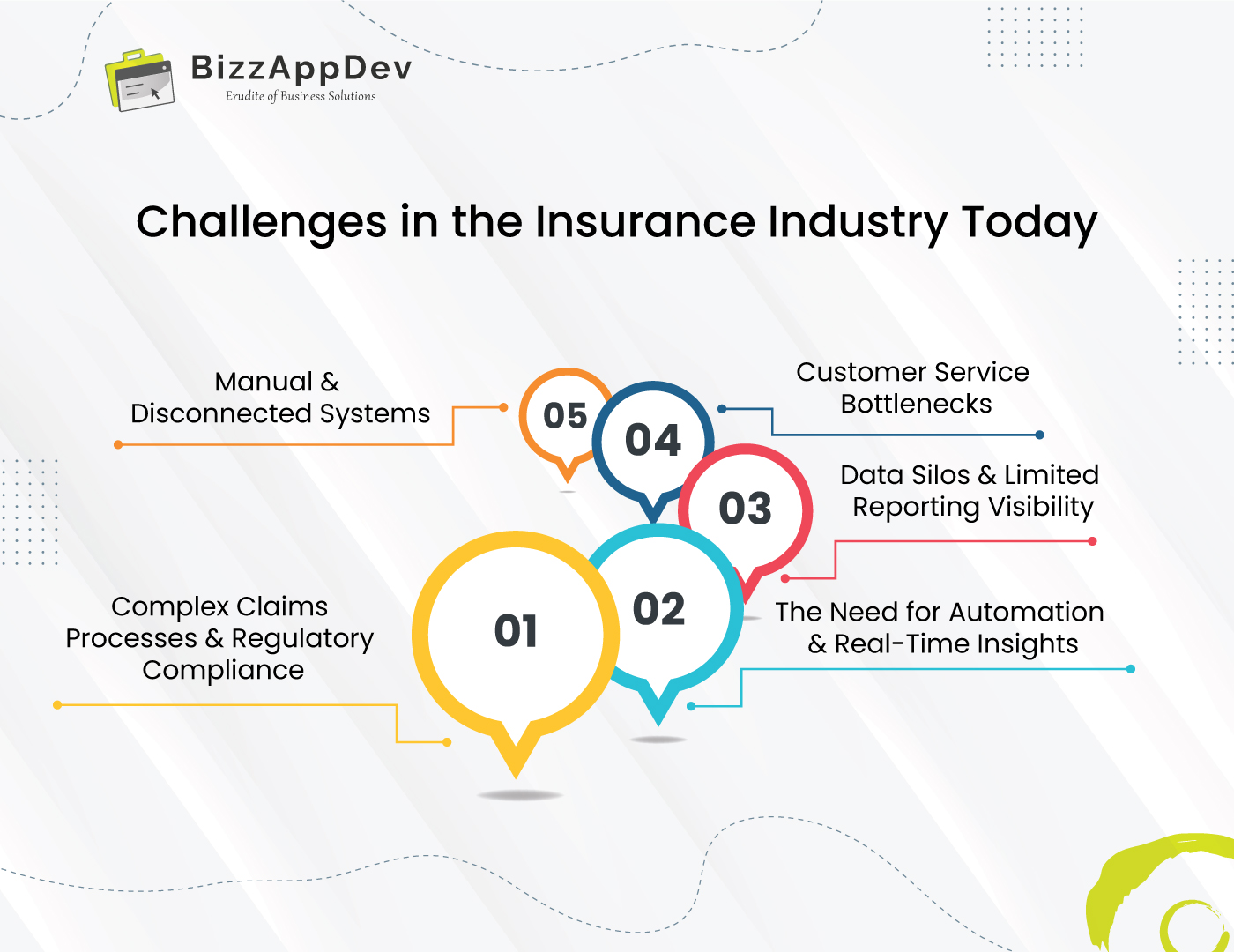

Challenges in the Insurance Industry Today

Running an insurance business today isn’t just about policies and premiums—it’s about data, compliance, and customer satisfaction. But with legacy systems and outdated workflows, most insurance companies are hitting the same roadblocks. Let’s decode what’s holding them back.

Manual & Disconnected Systems

Many insurers still rely on spreadsheets, emails, and fragmented software. These disconnected systems make it hard to access the right data at the right time, leading to delays, duplication, and errors across departments.

Complex Claims Processes & Regulatory Compliance

Processing claims often requires jumping through multiple hoops, document verification, approvals, compliance checks, and more. Add changing regulations to the mix, and it becomes a nightmare to ensure accuracy and timeliness without the right tools.

Customer Service Bottlenecks

From policy inquiries to claim follow-ups, customers expect fast responses. But when call centers and backend systems aren’t aligned, service reps struggle to deliver a seamless experience, resulting in frustration and lost trust.

Data Silos & Limited Reporting Visibility

Without a unified system, data lives in silos. This limits your ability to generate real-time reports, analyze performance, or forecast trends. You’re forced to rely on guesswork instead of data-driven decisions..

The Need for Automation & Real-Time Insights

Manual operations slow you down. What insurance companies need today is automation that reduces human error and real-time visibility to adapt quickly in a fast-changing market.

Clearly, the industry is ready for a shift, and that’s where ERP steps in.

Why ERP is Crucial for Insurance Management

Imagine a single system where your policies, claims, leads, customer data, and finances are all connected. That’s the kind of power ERP brings to the insurance table. Let’s explore why ERP for Insurance Management is a game-changer.

Centralized Data for Everything

From policy issuance and renewals to claim settlements and customer profiles, ERP brings it all under one roof. No more jumping between software. Just one dashboard to manage it all.

Automated Workflows That Save Time

ERP systems automate repetitive tasks like premium reminders, document verifications, and claim approvals. This not only improves turnaround time but also frees up your team to focus on more strategic work.

Seamless Lead-to-Policy Conversion

Integrated CRM tools track leads, follow up automatically, and help agents convert prospects into policyholders. Every interaction is logged, ensuring zero follow-up is missed.

Real-Time Compliance & Audit Trails

Built-in compliance features ensure every step of your process meets legal standards. Plus, audit trails and document history make internal reviews and external audits stress-free.

Enhanced Customer Experience

With access to real-time data, your customer service team can answer queries faster, resolve complaints efficiently, and deliver a truly personalized experience, exactly what today’s customers expect.

Scalable, Adaptable & Future-Ready

Whether you're a growing agency or an established insurance firm, ERP platforms like Odoo ERP for Insurance Management scale with you. Add new modules as needed, integrate with third-party tools, and stay ahead of the curve.

In short, ERP isn’t just software, it’s your operational backbone. Ready to explore its full potential? Let’s dive into the top benefits next.

Overview of Odoo ERP for Insurance Management

Odoo ERP for Insurance Management is a modular solution designed to align perfectly with the operational workflows of insurance companies. From policy handling to claims processing, every module can be tailored to match specific business needs.

Its biggest advantage? Scalability and customization. Whether you're a growing agency or a large firm, Odoo adapts effortlessly, ensuring your ERP evolves with you, not against you.

Integration is seamless, too. Odoo connects with CRMs, payment gateways, chatbots, and more, eliminating silos and bringing all critical tools into one unified system. Add to that real-time dashboards and workflow automation, and you get a system that enhances visibility, speeds up processes, and improves customer service across the board.

With everything under one platform, Odoo ERP for Insurance Management offers a smarter way to manage policies, improve decision-making, and serve customers with precision.

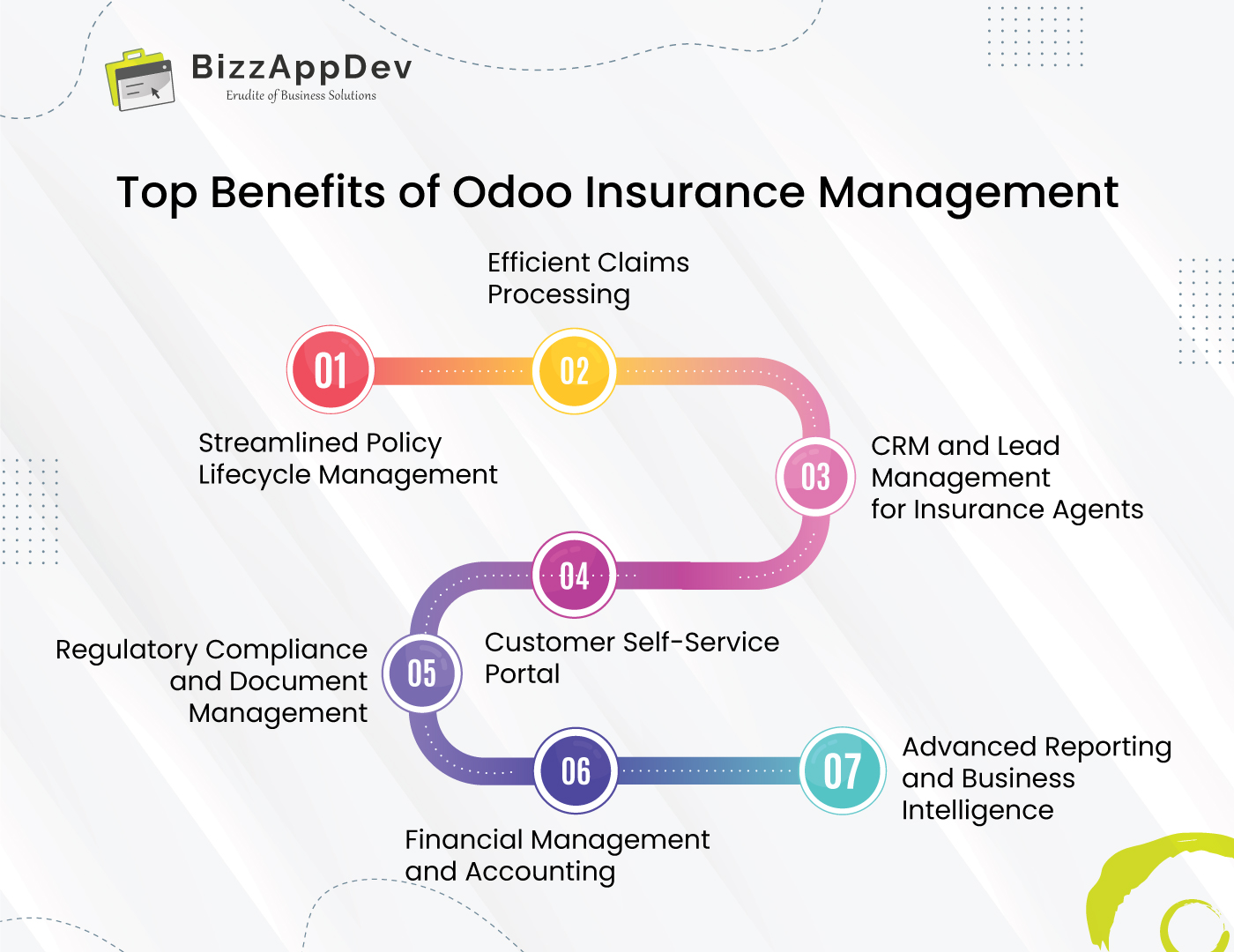

Top Benefits of Odoo Insurance Management

Odoo ERP for Insurance Management is designed to simplify, automate, and scale key insurance functions. From policy lifecycle automation to real-time BI dashboards, the benefits are endless. Let’s break down the top advantages and how they practically impact insurance providers.

1. Streamlined Policy Lifecycle Management

Managing the full lifecycle of a policy, right from issuance to cancellation, can get chaotic with legacy systems. With Odoo, this process is fully automated. You can issue new policies, send renewal alerts, and even manage endorsements or cancellations from a single dashboard.

Thanks to Odoo’s Sales and Subscription modules, insurers can track customer policy status, update documents, and monitor expiry dates in real time. No more missed renewals or scattered client records, everything is centralized and updated automatically.

2. Efficient Claims Processing

Claims management is one of the most sensitive and time-consuming areas for insurers. Odoo simplifies it by automating claims registration, document uploads, validation, and settlement.

Using Odoo Studio and Approval Flows, you can set up workflows that trigger the right actions, like assigning a claims adjuster or generating a payout report, at just the right time. This cuts down on human error, speeds up the process, and ultimately improves customer trust.

3. CRM and Lead Management for Insurance Agents

Insurance agents thrive on leads, and Odoo’s built-in CRM module ensures no lead slips through the cracks. Agents can track every prospect, manage follow-ups, and segment customers based on their policy interests or demographics.

The real win? With Odoo Marketing Automation, insurers can create targeted email and SMS campaigns to upsell or cross-sell policies. Whether it's nudging a lead about health insurance or reminding a customer about a car policy renewal, automation has you covered.

4. Customer Self-Service Portal

Today’s policyholders expect transparency and instant access. Odoo delivers this with a customer self-service portal where users can view their active policies, raise claims, check claim statuses, and download documents at any time, anywhere.

Built using Odoo Website Builder or integrated third-party portals, this self-service approach not only enhances customer satisfaction but also reduces the support team workload significantly.

5. Regulatory Compliance and Document Management

Staying compliant is non-negotiable in the insurance world. Odoo acts as a central document repository where KYC forms, ID proofs, contracts, and audit files can be securely stored and accessed.

With built-in alerts for upcoming renewals, automated audit trails, and version control, you’ll never miss a compliance deadline. Plus, user access rights ensure only the right people have visibility into sensitive data.

6. Financial Management and Accounting

Insurance accounting involves more than just premium tracking. With Odoo Accounting, you can manage claim liabilities, calculate agent commissions, automate invoicing, and even reconcile payments within one interface.

Reminders for unpaid premiums and automated payment follow-ups help improve cash flow. The system gives a full financial overview, ensuring that every rupee in or out is accounted for in real time.

7. Advanced Reporting and Business Intelligence

Odoo offers advanced business intelligence dashboards to monitor everything from claim ratios and policy profitability to customer acquisition costs.

Using Odoo BI, Spreadsheets, or external tools, you can create custom KPIs, generate visual reports, and identify trends, empowering smarter decision-making and helping you pivot faster in a competitive insurance market.

How to Implement Odoo ERP for Insurance Management

Implementing Odoo ERP for Insurance Management isn’t just about installing software, it’s about transforming operations, automating workflows, and empowering your team to work smarter. A successful implementation involves a series of well-planned steps that align with your insurance business’s goals and regulatory needs. Here’s how it unfolds:

Step-by-Step Implementation Process

The journey starts with requirement gathering, where stakeholders from underwriting, claims, customer service, and compliance come together to define what the ERP must deliver. This phase identifies pain points in your current system and outlines how Odoo should be customized to fix them.

Next comes system configuration and module selection. Whether you need policy lifecycle management, claims automation, CRM integration, or all of it, Odoo’s modular nature allows tailored solutions. After configuration, data migration takes place—importing your existing customer records, policy data, and financials into Odoo without disrupting daily operations.

Finally, after rounds of testing and UAT (User Acceptance Testing), your customized insurance ERP is ready to go live. And yes, all of this happens with minimum disruption to your existing business flow.

The Role of Experienced Odoo Partners

While Odoo is powerful, its true potential is unlocked when implemented by experienced Odoo partners. These certified experts specialize in understanding insurance-specific workflows and customizing Odoo modules accordingly, whether it’s designing claims approval logic or integrating with insurance-specific CRMs or regulatory portals.

Partners also help build seamless integrations with third-party services like payment gateways, chatbot interfaces, digital signature platforms, and more. They bring real-world experience and best practices to ensure your system is not just functional, but future-ready.

Post-Implementation Support, Training, and Scalability

Once the system is live, the job isn't over. You’ll need ongoing Odoo support for troubleshooting, updates, and enhancements. A good implementation plan includes employee training, documentation, and hands-on onboarding so your team can make the most of Odoo from day one.

And as your insurance business grows, be it in policy count, user base, or services offered, Odoo scales with you. Need to add new modules like helpdesk, BI analytics, or marketing automation? The ERP is ready for it, ensuring you're set for both today and tomorrow.

Conclusion

Odoo ERP for Insurance Management is redefining how insurance firms operate—from streamlining claims to ensuring compliance. With its modular architecture, automation-ready features, and seamless integrations, Odoo simplifies complex processes that once demanded hours of manual effort.

By leveraging Odoo, insurance companies can centralize customer data, automate policy workflows, reduce turnaround times, and maintain strict regulatory compliance all within a unified system. It’s not just a digital upgrade, it’s a smarter, scalable way to run your insurance operations in today’s competitive landscape.

Looking to digitize your insurance operations? Discover how our Odoo experts can help you today.

Transform your insurance business with Odoo ERP!

Get in touch with our team for a free consultation and start optimizing your workflows with Odoo ERP.

Related Blogs