1. Introduction: Why Multi-Company and Multi-Currency Matter in Odoo

In today’s global business landscape, many organizations manage operations across countries, currencies, and subsidiaries. That’s where Odoo’s multi-company and multi-currency features shine.

Whether you’re a multinational enterprise dealing with USD, EUR, and INR or a growing business managing multiple regional branches, Odoo makes it easy to handle separate entities, financials, and exchange rates, all within a single database.

In this guide, we’ll walk you through how to configure, manage, and optimize multi-company and multi-currency setups in Odoo for smooth global operations.

2. Understanding Odoo’s Multi-Currency System

Odoo’s multi-currency system allows your business to:

- Issue invoices and receive payments in different currencies

- Record transactions in foreign currencies

- Maintain bank accounts in multiple currencies

- Automatically update and track currency exchange rates

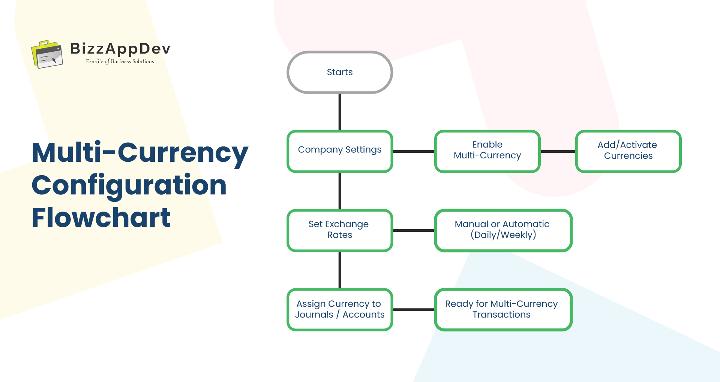

Main Currency Configuration

By default, your company’s main currency is set according to its country.

To change it:

Navigate to Accounting → Configuration → Settings → Currencies → Main Currency

You can select a new base currency that will be used for your company’s accounting and reports.

Enabling Foreign Currencies

- Go to Accounting → Configuration → Currencies

- Activate any currency you plan to use by toggling the Active button

Now your company can transact in multiple currencies simultaneously.

3. Managing Currency Rates

Keeping exchange rates up-to-date is essential for accurate reporting.

Option 1: Manual Updates

- Navigate to Accounting → Configuration → Currencies

- Open the currency you want to modify

- Under the Rates tab, click Add a line

- Enter the new exchange rate and date

Option 2: Automatic Updates

Odoo can fetch exchange rates automatically at regular intervals.

To enable this:

Go to Accounting → Settings → Currencies and set Automatic Currency Rates to Daily, Weekly, or Monthly.

You can also choose a rate provider service for fetching accurate data.

4. Handling Exchange Differences

Exchange rate fluctuations between invoice and payment dates can cause gains or losses. Odoo automatically records these as exchange difference entries.

To configure:

Go to Accounting → Settings → Default Accounts

Define the Journal, Gain Account, and Loss Account.

This ensures that profit/loss due to currency changes is automatically tracked.

5. Multi-Currency in Action: Invoices, Payments, and Bank Transactions

Odoo lets you select currencies at the document level for invoices, bills, and payments.

- Invoices & Bills: Choose the desired currency when creating the document.

- Payments: During payment registration, select the preferred currency in the pop-up.

- Bank Transactions: Add foreign currency amounts and Odoo will auto-convert them using the set exchange rate.

This flexibility ensures smooth international transactions and accurate reconciliation.

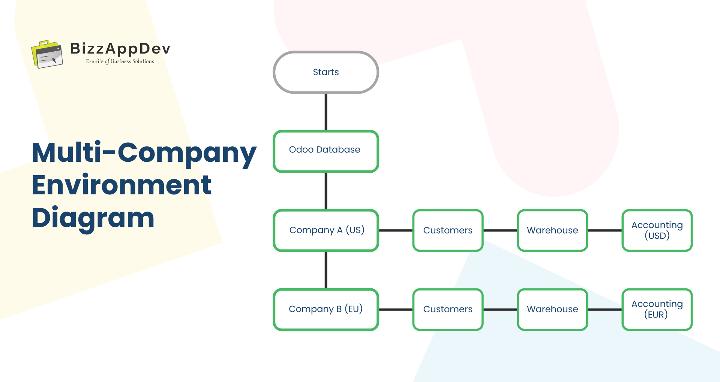

6. Setting Up Multi-Company in Odoo

Multi-company setup in Odoo allows you to manage multiple legal entities or branches under one database. This is perfect for companies with different subsidiaries or regional offices.

Creating a New Company

- Go to Settings → Users & Companies → Companies

- Click New

- Enter company details like name, address, and tax ID

- Save the configuration

You can also manage existing companies or archive inactive ones directly from the same view.

7. Managing Multi-Company Environments

User Access & Permissions

You can assign specific users to one or more companies and define their roles.

To switch between companies, use the Company Selector at the top-right of the dashboard.

This helps ensure data privacy and contextual accuracy.

Shared vs. Company-Specific Data

- Shared data (e.g., products, contacts) → Leave Company field empty

- Company-specific data (e.g., invoices, warehouses) → Select a company in the Company field

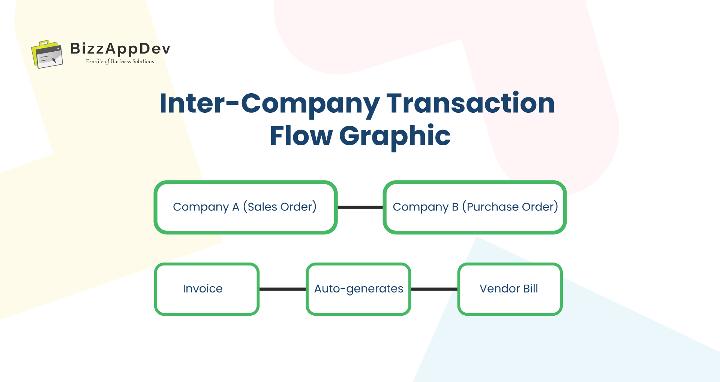

8. Inter-Company Transactions

For businesses where one subsidiary sells to another, Odoo’s Inter-Company Transactions feature automates the process.

To enable it:

Go to Settings → Companies → Enable Inter-Company Transactions

You can configure:

- Generate Bills and Refunds – Automatically creates a bill when another company posts an invoice.

- Generate Sales or Purchase Orders – Automatically creates counterpart documents when an order is confirmed.

Example:

If Company A in the U.S. sells goods to Company B in Europe, Odoo can automatically generate the corresponding purchase order and vendor bill in Company B’s books.

9. Use Cases

Multinational Retailer

A company with branches in the U.S. and Canada manages transactions in both USD and CAD, with inter-company sales. Odoo handles all conversions and consolidated reporting automatically.

Manufacturing Company with Separate Product Lines

A furniture company manages two product divisions under separate companies to streamline accounting while sharing product data.

This setup keeps operations organized without adding database complexity.

10. Conclusion

With Odoo’s robust multi-company and multi-currency features, managing complex, global business structures becomes simpler and more efficient.

Whether it’s handling multiple subsidiaries or ensuring accurate foreign exchange accounting, Odoo provides the flexibility and automation needed to scale confidently.

At BizzAppDev Systems, we help organizations configure, customize, and optimize their Odoo environments for seamless global operations.

Need help implementing multi-company or multi-currency Odoo setups?

Contact our experts today to streamline your global ERP management.